| Payment | Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | ☐ | Fee paid previously with preliminary materials. |

¨ | ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

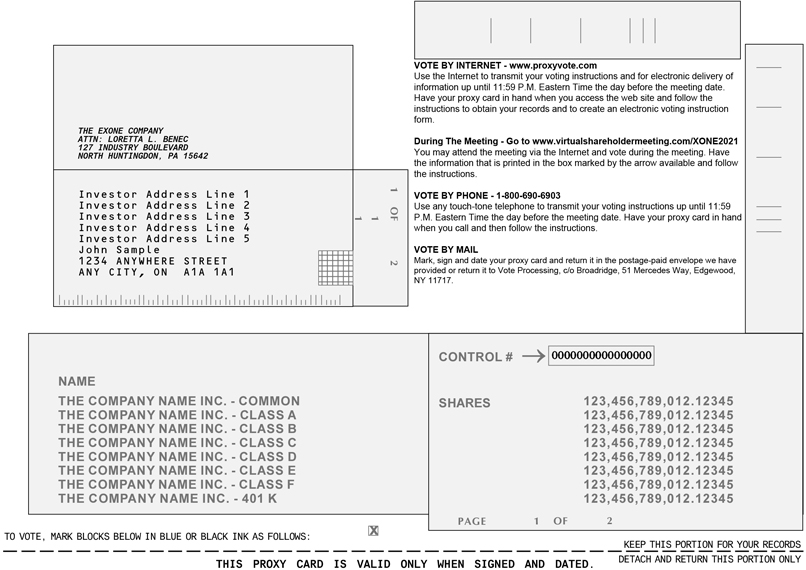

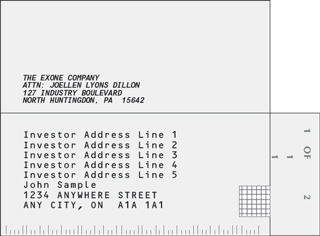

The ExOne Company 127 Industry Boulevard North Huntingdon, Pennsylvania 15642 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held On May 18, 201612, 2021 Dear Stockholder: You are cordially invited to attendparticipate in the 20162021 Annual Meeting of Stockholders of The ExOne Company (“ExOne” or the “Company”). The meeting will be held on May 18, 201612, 2021 at 10:00 a.m., Eastern Daylight Time, at ExOne’s principal executive offices, 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642.in a virtual online format. At the meeting, holders of ExOne’s issued and outstanding common stock (NASDAQ:(Nasdaq: XONE) will act upon the following matters: (1) Election of seven (7)eight (8) nominees to the Company’s Board of Directors identified in the accompanying Proxy Statement, each for a term that expires in 2017;2022; (2) Ratification of the appointment of Schneider Downs & Company,Co., Inc. as ExOne’sthe Company’s independent registered public accounting firm for the year ending December 31, 2016; and2021; (3) Approval of an amendment to the Company’s Certificate of Incorporation to specifically provide for stockholder removal of directors either with or without cause; (4) Approval, on a non-binding advisory basis, of the compensation paid to the Company’s named executive officers in 2020, as reported in the accompanying Proxy Statement; and (5) Any other matters that properly come before the meeting. The record date for the Annual Meeting is March 29, 2016.15, 2021. Only stockholders of record at the close of business on that date are entitled to receive notice of, to attendparticipate in and to vote at, the Annual Meeting and any postponements or adjournments thereof. This year, weTo participate in the Annual Meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/XONE2021 and enter the 16-digit control number found on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials (the “Internet Notice”). Once admitted, during the Annual Meeting, you may vote, submit questions and view the list of stockholders entitled to vote at the Annual Meeting by following the instructions available on the meeting website.

We are pleased to deliver our proxy materials to stockholders primarily over the Internet. Utilizing Internet delivery allows us to distribute our proxy materials in an environmentally responsible and cost-effective manner. On April 8, 2016,1, 2021, we mailed aan Internet Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to certain holders of record as of the record date, and posted our proxy materials on the website referenced in the Internet Notice. The Internet Notice explains how to access the proxy materials and the 20152020 Annual Report, free of charge, through the website described in the Internet Notice. The Internet Notice and website also provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email for this meeting and on an ongoing basis. If you received your Annual Meeting materials by mail, the Proxy Statement, 20152020 Annual Report, Notice of Annual Meeting and proxy card were enclosed. Your vote is very important, and we appreciate youryou taking the time to vote promptly. The proxy card contains instructions on how to vote by proxy, by telephone or through the Internet, or you may complete, sign and return the proxy card by mail. It is very important that your shares are represented at the Annual Meeting, whether or not you plan to attendparticipate in person.the Annual Meeting. Accordingly, we request and urge you to review the proxy materials and vote your shares in advance of the meeting. If you decide to attendparticipate in the Annual Meeting, and wish to vote in person,at that time, you may do so by revoking your proxy at that time. Also, if you plan to attend the meeting in person and need directions, please contact the office of the Executive Vice President, Chief Legal Officer and Corporate Secretary at (724) 863-9663. To ensure your vote is counted at the Annual Meeting, please vote as promptly as possible. | By Order of the Board of Directors,

|

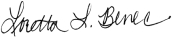

| JLOELLENORETTA LL. BYONS DILLONENEC

| Executive Vice President, Chief Legal OfficerGeneral Counsel and

Corporate Secretary | April 8, 20161, 2021 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR STOCKHOLDERSTHE STOCKHOLDER MEETING TO BE HELD ON MAY 18, 2016:12, 2021: OUR 2016 PROXY STATEMENT, 20152020

ANNUAL REPORT AND NOTICE OF ANNUAL MEETING ARE AVAILABLE WITH YOUR 16-DIGIT 16-DIGITCONTROL NUMBER AT HTTP://WWW.PROXYVOTE.COM.WWW.PROXYVOTE.COM.

PROXY SUMMARY Meeting Information | | | | Date: | | May 18, 201612, 2021 | | | | Time: | | 10:00 a.m. Eastern Daylight Time | | | Place:Virtual Online Meeting Site: | | Our Principal Executive Offices: 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642www.virtualshareholdermeeting.com/XONE2021 | | | | Proposals: | | (1) Election of seven (7)eight (8) nominees to the Company’s Board of Directors (the “Board”) (2) Ratification of the appointment of Schneider Downs & Company,Co., Inc. as ourthe Company’s independent registered public accounting firm for 20162021 (3) Approval of an amendment to the Company’s Certificate of Incorporation to specifically provide for stockholder removal of directors either with or without cause (4) Approval, on a non-binding advisory basis, of the compensation paid to the Company’s named executive officers in 2020 (5) Any other matters that properly come before the meeting |

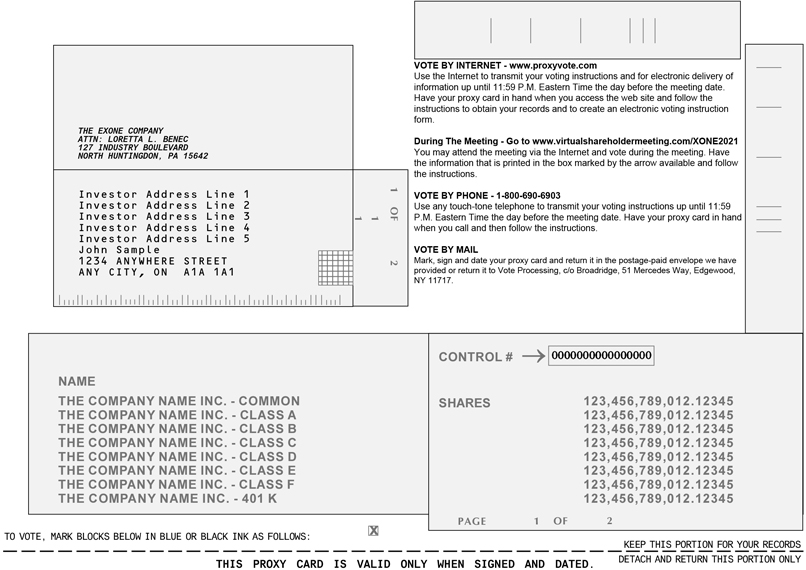

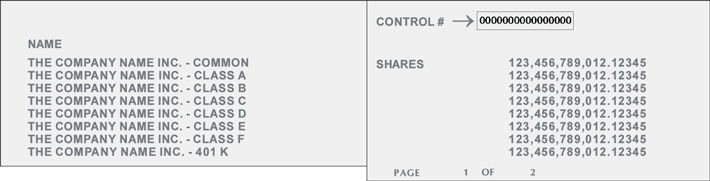

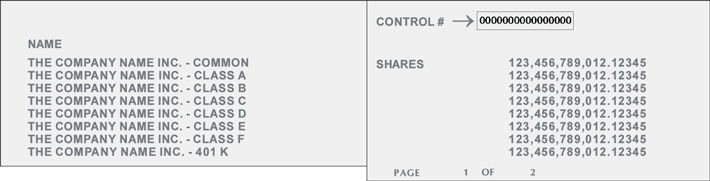

How to Vote — Your vote is important Record Date. You are eligible to vote if you were a stockholder of record at the close of business on Tuesday,Monday, March 29, 2016.15, 2021. To make sure that your shares are represented at the meeting, please cast your vote as soon as possible. Beneficial Owners. If you hold your shares through a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. Please follow the instructions that you receive to vote your shares. Registered Owners. If you are a registered holder, please complete and sign the enclosed proxy card and return it to Broadridge by following the instructions on the card. You also may vote your shares by telephone, or over the Internet or during the meeting as described on your proxy card. Online Access to Proxy Materials The Proxy Statement, 20152020 Annual Report and Notice of Annual Meeting are available with your 16-digit control number atHTTP:http://WWW.PROXYVOTE.COM.www.proxyvote.com.

Election of Directors This year, we are recommending the election of seven (7)eight (8) nominees to the Board: | | | | | | | | | | | Name | | Age | | | Independent | | | Position with ExOne | S. Kent Rockwell | | | 7176 | | | | No | | | Chairman and Chief Executive Officer and member of Strategic Oversight Committee | John IrvinPaul A. Camuti

| | | 61 | | | | No | | | Director | Raymond J. Kilmer

| | | 50 | | | | Yes | | | Chair of Strategic Oversight Committee and member of Compensation Committee and Nominating and Governance Committee | Gregory F. Pashke

| | | 6859 | | | | Yes | | | Director nominee for first term | Lloyd A. SempleJohn F. Hartner

| | | 7658 | | | | YesNo | | | | Lead Director, Chair of Nominating and Governance Committee and member of Compensation CommitteeChief Executive Officer | William F. StromeJohn Irvin

| | | 6166 | | | | No | | | Director | Gregory F. Pashke | | | 73 | | | | Yes | | | Director and member of Audit Committee and Strategic OversightNominating and Governance Committee | William F. Strome | | | 66 | | | | Yes | | | Director, Chair of Audit Committee and member of Nominating and Governance Committee and Compensation Committee | Roger W. Thiltgen | | | 70 | | | | Yes | | | Director and member of Nominating and Governance Committee and Compensation Committee | Bonnie K. Wachtel | | | 6065 | | | | Yes | | | Director, Chair of Compensation Committee and member of Audit Committee |

Five of the seveneight nominees are “independent” under the NASDAQThe Nasdaq Stock Market (“NASDAQ”Nasdaq”) rules.

Compensation Highlights Since February 2018, ExOne has had a written pay philosophy codifying ExOne’s executive compensation is performance driven.goals and governing principals, which it reviews annually and was most recently updated in February 2021. TheFor 2020, our named executive officers received a combination of base salary and time-vested long-term equity incentive awards.

In response to the economic effects of the COVID-19 pandemic, the named executive officers had their salaries reduced by 20% for most of the second quarter, and had 20% of their base salaries for the third and fourth quarters of 2020 replaced with a restricted stock award that vested one-half on September 30, 2020 and one-half on December 31, 2020. In February 2020, the Compensation Committee and fullof the Board adopted the 2015 Umbrella Annual Incentive Plan in March 2015, under2020 annual incentive program which provided an opportunity for performance-based compensation to senior executive officers of the 2013 Equity Incentive Plan, to reward ExOne executives forCompany based on the achievement of pre-established Company performancetarget goals (revenuefor revenue and gross profit)Adjusted EBITDA (earnings before interest, taxes, depreciation and individual goals. Becauseamortization) (defined on page 31). As the Company didgoals of the 2020 annual incentive program were not meet its 2015 performance goals,achieved, no incentivespayouts were paid under the 2015 Umbrella Annual Incentive Plan.made.

Corporate Governance Highlights Our Board is committed to establishing and maintaining corporate governance policies and practices that are appropriate for a company like ExOne. Highlights of our implemented measures include: Strong independentIndependent Lead Director and enhanced use of independent committees to ensure a balanced process;

Annual election of directors; Majority voting standard for non-contested election of directors; Supermajority of independent directors on the Board (5 out of 78 independent directors upon election at 2016the 2021 Annual Meeting); 100% independent members on Audit, Compensation and Nominating and Governance Committees; Stock ownership and retention policy for directors and executive officers; Anti-hedging and anti-pledging policies for directors and executive officers; (ii)

Clawback policy for restatement of financial statements; Succession and executive talent planning at the Board level; Strong ethicsEthics policy, whistleblower policy and international policies on import and export matters;

Process for review and approval of related person transactions; Establishment of a committee of senior executives to oversee the Company’s environmental, social and governance initiatives and disclosures; Board compensation in form and amount appropriate for our size and state of development; and Annual Board self-evaluation process. Ratification of Independent Registered Accounting Firm We are recommending the ratification of the appointment of Schneider Downs & Company,Co., Inc. as ExOne’s independent registered public accounting firm for the year ending December 31, 2016.2021. Amendment to Certificate of Incorporation We are recommending the approval of an amendment to the Company’s Certificate of Incorporation to specifically provide for stockholder removal of directors either with or without cause. Say-on-Pay We are recommending the approval, on a non-binding advisory basis, of the compensation paid to the Company’s named executive officers in 2020, as reported in the Proxy Statement. (iii)

i

The ExOne Company 127 Industry Boulevard North Huntingdon, Pennsylvania 15642 PROXY STATEMENT FOR THE 20162021 ANNUAL MEETING OF STOCKHOLDERS To Be Held On May 18, 201612, 2021 at 10:00 a.m., Eastern Daylight Time in an Online Virtual Format QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING Why am I receiving these materials? The Board of Directors (the “Board”) of The ExOne Company (“we,” the “Company,” or “ExOne”) is soliciting your proxy to vote at the 20162021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 18, 201612, 2021 at 10:00 a.m., Eastern Daylight Time, at ExOne’s principal executive offices, 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642.in an online virtual format. You are invited to attendparticipate in the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attendparticipate in the meeting to vote your shares. If you are a registered holder, you may vote in advance of the meeting by telephone, over the Internet or by completing, signing and returning a proxy card to us at 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642.Broadridge by following the instructions on the card. If you hold your shares through a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. Please follow the instructions that you receive to vote your shares. We intend to mail to all stockholders of record entitled to vote at the Annual Meeting either the Notice of Internet NoticeAvailability of Proxy Materials (the “Internet Notice”) or a full set paper copy of this Proxy Statement, together with our 20152020 Annual Report, the Notice of Annual Meeting and the accompanying proxy card on or about April 8, 2016.1, 2021. Copies of our 20152020 Annual Report furnished to our stockholders do not contain copies of exhibits to our Annual Report on Form 10-K for the year ended December 31, 2015.2020. You can obtain copies of these exhibits electronically at the SEC’s website of the Securities and Exchange Commission (the “SEC”) atwww.sec.gov or by mail from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. TheCopies of the exhibits are also available as part of the Form 10-K for the year ended December 31, 20152020 which is availablecan be accessed on ExOne’s corporate website atwww.exone.com. Stockholders may also obtain copies of exhibits without charge by contacting our Executive Vice President, Chief Legal Officer and Corporate Secretary at (724) 863-9663. We will also post this Proxy Statement, our 20152020 Annual Report and the Notice of Annual Meeting on the Internet atHTTP:http://WWW.PROXYVOTE.COMwww.proxyvote.com on or about April 8, 2016,1, 2021, which you may access using your16-digit control number. Why did I receive an Internet Notice in the mail regarding the Internet availability of proxy materials instead of a full set paper copy of this Proxy Statement, the 20152020 Annual Report and the Notice of Annual Meeting? We are taking advantage of an SEC rule that allows companies to furnish their proxy materials over the Internet rather than in paper form. This rule allows a company to send some or all of its stockholders the Internet Notice regarding Internet availability of proxy materials. Notice. Instructions on how to access the proxy materials over the Internet or how to request a paper copy of proxy materials may be found in the Internet Notice. If you would prefer to receive proxy materials (including a proxy card) in printed form by mail or electronically by email, please follow the instructions contained in the Internet Notice. Why didn’t I receive an Internet Notice in the mail regarding the Internet availability of proxy materials? The SEC rule that allows us to furnish our proxy materials over the Internet rather than in paper form does not require us to do so for all stockholders. We may choose to send certain stockholders the Internet Notice, while sending other stockholders a full set paper copy of our Proxy Statement, 20152020 Annual Report, Notice of Annual Meeting and proxy card. Who can vote at the Annual Meeting and when is the Record Date?record date? Only stockholders of record at the close of business on March 29, 201615, 2021 are entitled to vote at the Annual Meeting. OnAt the close of business on the record date, there were 16,067,95422,073,724 shares of ExOne common stockCommon Stock (“Common Stock”) outstanding. All holders of these outstanding shares are entitled to one vote for each share of Common Stock held by them as of the close of business on March 29, 201615, 2021 for each matter to be voted on at the Annual Meeting. A complete list of the stockholders of the Company as of the record date is available and open for examination by stockholders of the Company through the Annual Meeting date and will be available for viewing at the Annual Meeting through the meeting website. In light of current stay-at-home and similar orders resulting from the ongoing COVID-19 pandemic, you may send a written request to us if you desire to examine the stockholder list in advance of the Annual Meeting, and we will make arrangements to accommodate your request. Please submit this request, along with proof of stock ownership, in an email to us through our website at www.investor.exone.com/contact-us. How can I access the proxy materials over the Internet? An electronic copy of this Proxy Statement, the 20152020 Annual Report and the Notice of Annual Meeting are available with your 16-digit control number atHTTP:http://WWW.PROXYVOTE.COMwww.proxyvote.com. What proposals are being considered? There are twofour matters scheduled for a vote at the Annual Meeting: | | • | | Proposal No. 1: 1:Election of the seven (7)eight (8) nominees to the Board identified in Proposal No. 1, each for a term that expires at the 20172022 Annual Meeting of Stockholders. |

| | • | | Proposal No. 2: Ratification of the appointment of Schneider Downs & Company,Co., Inc. as ExOne’sthe Company’s independent registered public accounting firm for the year ending December 31, 2016.2021. |

| • | | Proposal No. 3: Approval of an amendment to the Company’s Certificate of Incorporation to allow for stockholder removal of directors either with or without cause. |

| • | | Proposal No. 4: Approval, on a non-binding advisory basis, of the compensation paid to the Company’s named executive officers in 2020. |

How do I vote? For Proposal No. 1, you may vote“For” “For” or“Against” “Against” each director nominee or you may“Abstain” “Abstain” from voting for any nominee. For Proposal No.Nos. 2, 3 and 4, you may vote“For” or“Against” “Against” theeach proposal, or“Abstain” “Abstain” from voting.voting on such proposal. Stockholder of Record (Shares Registered in Your Name) – — If on March 29, 2016,15, 2021, your shares were registered directly in your name with ExOne’s transfer agent, American Stock Transfer & Trust, LLP, then you are a stockholder of record with respect to those shares. As a stockholder of record, you may vote by proxy by telephone, over the Internet or by returning a proxy card, or you may vote in persononline at the Annual Meeting. Regardless of whether you plan to attendparticipate in the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attendparticipate in the meeting and vote in persononline during the meeting if you have already voted by proxy. If you received your proxy materials in the mail, you may vote your shares by proxy over the Internet, by telephone or by returning your proxy card by mail in the envelope provided. Instructions to vote over the Internet or by telephone are printed on your proxy card. To vote using the proxy card, please complete, sign and date the enclosed proxy card and return it promptly to us.Broadridge. If you vote by proxy by telephone, over the Internet or by returning your signed proxy card to usBroadridge before the Annual Meeting, we will vote your shares as you direct. To vote in person, please come to the Annual Meeting and we will give you a ballot when you arrive.

| • | | To vote online during the Annual Meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/XONE2021 and enter the 16-digit control number found on your proxy card, voting instruction form or Internet Notice. Once admitted, during the Annual Meeting, you may vote by following the instructions available on the meeting website. |

Beneficial Owner (Shares Registered in the Name of a Broker, Bank or Other Nominee) – — If on March 29, 2016,15, 2021, your shares were held in an account at a broker, bank, or other similar organization as your nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares in your account. Please refer to the voting instructions provided by your broker, bank or other nominee. Many organizations allow beneficial owners to give voting instructions via telephone or the Internet, as well as in writing. You also are invited to attend the Annual Meeting, but you will need to bring a copy of a brokerage statement reflecting stock ownership as of March 29, 2016. Because you are not the stockholder of record, you may not vote your shares in person at the meeting, unless you provide a valid proxy (sometimes referred to as a “legal proxy”) from your broker, bank or other nominee. How many votes do I have? You have one vote for each share of Common Stock you own as of the close of business on March 29, 201615, 2021 for each matter to be voted on at the Annual Meeting. You may vote on each proposal presented for consideration at the 2016 Annual Meeting. There are no cumulative voting rights with respect to our Common Stock. What if I return a proxy card but do not make specific choices? If you return a signed and dated proxy card without marking any voting selections, your shares will be voted“For” “For” the election of each of the seven (7)eight (8) nominees for director, and“For” ratification of Schneider Downs & Company,Co., Inc. as our independent registered public accounting firm for the year ending December 31, 2016.2021, “For” the approval of the amendment to the Certificate of Incorporation, and “For” the advisory approval of the compensation paid to the Company’s named executive officers in 2020. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment. WhatHow do I needparticipate in the virtual online Annual Meeting?

We are conducting a virtual online Annual Meeting this year so our stockholders can participate from any geographic location with Internet connectivity, which we believe is important in light of the COVID-19 pandemic and to dosupport the health and well-being of our stockholders, directors and employees. We have designed the format of the virtual online Annual Meeting to attendprovide stockholders the same ability to participate that they would have at an in-person meeting. To participate in the Annual Meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/XONE2021 and enter the 16-digit control number found on your proxy card, voting instruction form or Internet Notice. Once admitted, during the Annual Meeting, you may vote, submit questions and view the list of stockholders entitled to vote at the Annual Meeting by following the instructions available on the meeting website. Access to the meeting platform will begin at 9:50 a.m. EDT on May 12, 2021. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the meeting website login page at www.virtualshareholdermeeting.com/XONE2021. Technical support will be available beginning at 9:30 a.m. EDT on May 12, 2021 and will remain available until the meeting has ended. Rules for the conduct of the Annual Meeting will be available on the meeting website. To obtain a copy of the rules of conduct for the Annual Meeting in person? Space foradvance of the Annual Meeting, is limited. Therefore, admission will be on a first-come, first-served basis. Registration will openplease submit an email to us through our website at 9:00 a.m. Eastern Daylight Time, andwww.investor.exone.com/contact-us.

Regardless of whether you plan to participate in the Annual Meeting, will begin at 10:00 a.m. Each stockholder shouldit is important that your shares be prepared to present: | 1. | Valid government issued photo identification, such as a driver’s license or passport; and |

| 2. | Beneficial owners holding their shares through a broker, bank or other nominee will need to bring proof of beneficial ownership as of March 29, 2016, the record date, such as their most recent account statement reflecting their stock ownership prior to March 29, 2016, a copy of the voting instruction card provided by their broker, bank or other nominee, or similar evidence of ownership. |

Use of cameras, recording devices, computersrepresented and other electronic devices, such as smart phones and tablets, are not permittedvoted at the Annual Meeting. Photography and video are prohibited atAccordingly, we encourage you vote in advance of the Annual Meeting.

Please allow ample time for check-in. Please note that large bags and packages are not allowedMeeting at the Annual Meeting. Persons may be subject to search.www.proxyvote.com.

Who is paying for this proxy solicitation? ExOne will pay for the entire cost of soliciting proxies. In addition to ExOne mailing these proxy materials, ExOne’s directors and employees also may solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. ExOne may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. What does it mean if I receive more than one set of proxy materials? If you receive more than one set of proxy materials (including multiple Internet Notices or multiple copies of this Proxy Statement, Notice of Annual Meeting and proxy card), your shares are registered in more than one name or are registered in different accounts. Please make sure that you vote all of your shares by following the directions on each Internet Notice or proxy card. Can I change my vote after submitting my proxy? Yes. You can revoke your proxy and change your vote at any time before the final vote at the meeting. If you are a stockholder of record, you may change your vote in any one of the following ways:

You may submit another properly completed proxy or voting instruction form (including by telephone or over the Internet) with a later date. You may participate in the virtual online Annual Meeting and vote at the meeting. Simply participating in the virtual online meeting will not, by itself, revoke your proxy. You may send a written notice that you are revoking your proxy to our Corporate Secretary at The ExOne Company, 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642. How many votes are needed to approve each proposal? Proposal No. 1. Directors will be elected by the vote of a majority of the shares cast with respect to the director at the Annual Meeting. This means that the number of votes cast “For” a director’s election must exceed the number of votes cast “Against” that director’s election. Stockholders may not cumulate votes in the election of directors. You may attendProposal No. 2. Ratification of the appointment of Schneider Downs & Co., Inc. as ExOne’s independent registered public accounting firm for the year ending December 31, 2021 requires the affirmative vote of a majority of the shares represented at the Annual Meeting and entitled to vote on this matter.

Proposal No. 3. Approval of the amendment to the Certificate of Incorporation requires the affirmative vote of at least 75% of the voting power of all outstanding shares of capital stock of the Company generally entitled to vote in person by ballot. Simply attending the meeting will not, by itself, revoke your proxy. If you areelection of directors, voting together as a beneficial owner of shares held in street name, you may change your vote in any onesingle class.

Proposal No. 4. Advisory approval of the following ways: You may submit new voting instructionscompensation paid to your broker, bank or other nominee.

If you have obtainedthe Company’s named executive officers in 2020 requires the affirmative vote of a legal proxy from the broker, bank or other nominee that holds your shares giving you the right to votemajority of the shares by attendingrepresented at the Annual Meeting and voting in person.entitled to vote on this matter.

How are votes counted? We have designated a representative of C. T. Hagberg LLCBroadridge Financial Services as the inspector of elections who will validate the votes. With respect to Proposal No. 1, the inspector of elections will count ““For”For” votes and ““Against”Against” votes. Abstentions and broker non-votes will not be counted as having been voted on the proposal, nor will they affect the outcome of Proposal No. 1.this proposal. With respect to Proposal No. 2, the inspector of elections will count separately ““For,” “Against”“Against” and ““Abstain”Abstain” votes and broker non-votes. ““Abstain”Abstain” votes will be counted towards the vote total for the proposal, and will have the same effect as ““Against”Against” votes. Because broker non-votes are not deemed to be votes entitled to be cast on the matter, they will not affect the outcome of Proposal No. 2. See “How many votes are needed to approve each proposal?” for further details regarding the votes needed to approve eachthis proposal.

With respect to Proposal No. 3, the inspector of elections will count separately “For,” “Against” and “Abstain” votes and broker non-votes. In accordance with Delaware law, only votes cast “for” a matter constitute affirmative votes. Accordingly, abstentions and broker non-votes will have the same effect as “Against” votes on this proposal. With respect to Proposal No. 4, the inspector of elections will count separately “For,” “Against” and “Abstain” votes and broker non-votes. “Abstain” votes will be counted towards the vote total for the proposal, and will have the same effect as “Against” votes. Because broker non-votes are not deemed to be votes entitled to be cast on the matter, they will not affect the outcome of this proposal. What is a “broker non-vote”? If your shares are held by your broker, bank or other similar organization as your nominee (that is, in “street name”), you will need to follow the voting instructions provided by that organization on how to vote your shares. If you do not provide voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker, bank or other nominee is not permitted to vote on that matter, including the election of directors, without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, while broker non-votes will be counted as present for the purpose of determining the presence of a quorum at the meeting, broker non-votes willnot affect the outcome on Proposals No. 1, 2, and 4. Because Proposal No. 3 requires the affirmative vote of any matter being votedat least 75% of the voting power of all outstanding shares of capital stock of the Company, broker non-votes will have the same effect as “Against” votes on at the meeting.that proposal. How many votesWhat are needed to approve each proposal?the Board’s voting recommendations?

Proposal No. 1. 1: Directors will be elected by the vote“For” election of a majorityeach of the shares cast with respecteight (8) nominees to the director at the Annual Meeting. This means that the number of votes cast“For” a director’s election must exceed the number of votes cast“Against” that director’s election. Stockholders may not cumulate votes in the election of directors. Abstentions and broker non-votes will not be counted as having been voted on the proposal, nor will they affect the outcome of this proposal.Board. Proposal No. 2. 2: Ratification“For” ratification of the appointment of Schneider Downs & Company,Co., Inc. as ExOne’s independent registered public accounting firm for the year ending December 31, 2016 requires the affirmative vote of a majority2021. Proposal No. 3: “For” approval of the shares represented atamendment to the Annual Meeting and entitledCertificate of Incorporation to vote on this matter. Abstentions will have the same effect as an“Against” vote. Because broker non-votes are not deemed to be votes entitled to be cast, they will not affect the outcomespecifically allow for stockholder removal of this proposal.directors either with or without cause. What areProposal No. 4: “For” the Board’s voting recommendations?non-binding approval of the compensation paid to the Company’s named executive officers in 2020, as reported in this Proxy Statement.

| • | | Proposal No. 1: “For” election of each of the seven (7) nominees to the Board.

|

| • | | Proposal No. 2: “For” ratification of the appointment of Schneider Downs & Company, Inc. as ExOne’s independent registered public accounting firm for the year ending December 31, 2016.

|

What is the quorum requirement? A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if a majority of all outstanding shares entitled to vote is represented by stockholders present virtually at the meeting or represented by proxy. OnAt the close of business on the record date, there were 16,067,95422,073,724 shares of Common Stock outstanding and entitled to vote. This means that at least 8,033,97811,036,863 shares must be represented by stockholders present virtually at the meeting or represented by proxy to have a quorum. Your shares will be counted towards the quorum if you submit a valid proxy or vote atattend the meeting.virtual online Annual Meeting. How can I find out the results of the voting at the Annual Meeting? Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting. In the event we are unable to obtain the final voting results within four business days, we will file the preliminary voting results in a Current Report on Form 8-K within four business days following the Annual Meeting, and will file an amended Current Report on Form 8-K with the final voting results within four business days after the final voting results are known. How can stockholders submit a proposal for inclusion in our Proxy Statement for the 20172022 Annual Meeting of Stockholders? Our 20172022 Annual Meeting of Stockholders will be held on May 17, 201711, 2022 at 10:00 a.m. To be included in our Proxy Statement for the 20162022 Annual Meeting of Stockholders, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion, such proposals must be received by ExOne by December 9, 2016,2, 2021, which is at least 120 calendar days before the anniversary date of the release of ExOne’s Proxy Statement to stockholders in connection with the previous year’s annual meeting. How can stockholders submit nominations of persons for election to the Board or proposals of business to be transacted by the stockholders for the 20172022 Annual Meeting of Stockholders? A stockholder of record may submit nominations of persons for election to the Board or proposals of business to be transacted by the stockholders only if he or she complies with Article III, Section 13 of our Amended and Restated Bylaws, as amended (the “Bylaws”). This section provides that a stockholder must give advance notice to our Corporate Secretary of any business, including nominations of directors for our Board, that the stockholder wishes to raise at the 20172022 Annual Meeting of Stockholders at our principal executive offices (i) not earlier than 120 days prior to such meeting, and (ii) at least 45 days prior to the anniversary date of the filing of ExOne’s Proxy Statement with the SEC in connection with the previous year’s annual meeting. Therefore, for the 20172022 Annual Meeting, such notice must be received by ExOne no sooner than January 17, 201711, 2022 and no later than February 22, 2017.15, 2022. With respect to a stockholder’s nomination of a candidate for our Board, the stockholder notice to our Corporate Secretary must contain certain information as set forth in our Bylaws about both the nominee and the stockholder making the nomination. With respect to any other business that the stockholder proposes, the stockholder notice must contain a brief description of such business, the reasons for conducting such business at the meeting, any personal or other direct or indirect material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made, and certain other information specified in our Bylaws. If you wish to bring a stockholder proposal or nominate a candidate for director, you are advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. If a stockholder wishes only to recommend a candidate for consideration by the Nominating and Governance Committee as a potential nominee for director, see the procedures discussed in “Corporate Governance — Nominating and Governance Committee Director Nomination Process.” What are the implications of being an “emerging growtha “smaller reporting company”? WeFollowing the SEC’s amendment to the definition of “smaller reporting company” in Rule 12b-2 of the Exchange Act, which was effective on September 10, 2018, we qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”). An emerging growtha smaller reporting company and may take advantage of specifiedthe scaled disclosure requirements applicable to smaller reporting companies. Many of the same reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicablepreviously available to public companies.

As an emerging growth company:

We are exempt from the requirement to obtain an attestation and report from our independent registered public accounting firm on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

We are permitted to provide less extensive disclosure about our executive compensation arrangements;

We are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements; and

We have elected to use an extended transition period for complying with new or revised accounting standards.

We will continue to operate under these provisions through December 31, 2018, or such earlier time that we no longer qualifyus as an emerging growth company. We would ceasecompany are now available to be an emerging growth company if we have more than $1.0 billion in annual revenues, qualifyus as a “large accelerated filer” under the Exchange Act, which requires ussmaller reporting company, in addition to have more than $700 million in market value of our Common Stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of these reduced burdens.others.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS General This year, the Nominating and Governance Committee has selected seveneight (8) nominees for election to the Board for consideration at the Annual Meeting; our Board has approved the nominees. Seven (7) of the nominees are current members of the Board, and Mr. Camuti is a new nominee for his first term on the Board. Mr. Camuti was recommended as a director nominee by a non-management director and was subsequently vetted by the Board. Lloyd A. Semple is retiring and will not stand for re-election at the end of his current director term. Each nominee elected as a director at the Annual Meeting will continue to serve until the 20172022 Annual Meeting of Stockholders, until his or her successor has been elected or qualified, or until his or her earlier death, resignation or removal. Victor Sellier will not stand for re-election at the end of his current director term. Director Qualifications Our Nominating and Governance Committee believes each member of our Board and nominee for director possesses the individual qualities necessary to serve on ExOne’s Board, including high personal and professional ethical standards and integrity, honesty and good values. Our directors and director nominees are highly educated and have diverse backgrounds and extensive track records of success in what we believe are highly relevant positions with large international companies, firms and major private and public institutions. Our incumbent directors have each demonstrated an ability to exercise sound judgment and have exhibited a commitment of service to ExOne and to the Board, and each of our directors and director nominees possesses strong communication skills. In addition, we believe that each director and director nominee brings the skills, experience and perspective that, when taken as a whole, createscreate a Board that possesses the requirements necessary to oversee ExOne’s business. Each nominee’s particular experience, qualifications, attributes and skills that led the Board to conclude that such nominee should serve as a director for ExOne are set forth below under“Nominees” “Nominees.”. Vote Required Directors will be elected by the vote of a majority of the shares cast with respect to the director at the Annual Meeting. This means that the number of votes cast ““For”For” a director’s election must exceed the total number of votes cast ““Against”Against” that director’s election. Stockholders may cast their votes “For” or “Against” the election of each director, or may abstain from voting with respect to any director nominee. Abstentions and broker non-votes will not be counted as having been voted on the proposal, nor will they affect the outcome of Proposal No. 1. If a nominee is not elected, the director shall offer to tender his or her resignation to the Board.Board in accordance with the Bylaws. The Nominating and Governance Committee of the Board will make a recommendation to the Board as to whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and rationale within 90 days following the date of the certification of the election results. The director who tenders his or her resignation will not participate in the Board’s decision with respect to that resignation. The proxy holders intend to vote all proxies received by them ““For”For” the nominees listed below unless otherwise instructed. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the current Board to fill the vacancy. As of the date of this Proxy Statement, the Board is not aware that any nominee is unable or will decline to serve as a director. The Board Recommends a Vote “FOR” the Election of Each Director Nominee. Nominees The following is a description of each nominee (in alphabetical order) for election to the Board: | | | | | Name | | Age | | Experience and Qualification | | Paul A. Camuti | | 59 | | Mr. Camuti is a nominee for his first term on our Board of Directors this year. He has served as Executive Vice President and Chief Technology and Strategy Officer of Trane Technologies plc since January 1, 2020, overseeing the company’s global strategy and innovation practices, enterprise sustainability and investment strategies, and networks of excellence in areas such as modeling and simulation and digital development. From August 1, 2011 to December 31, 2019, Mr. Camuti worked for Trane Technologies’ predecessor, Ingersoll Rand, where he was Senior Vice President of Innovation and Chief Technology Officer. In that role, he led the enterprise strategy organization and oversaw the full spectrum of innovation, technology and growth initiatives within the company. Mr. Camuti also led Ingersoll Rand’s enterprise focus on sustainability, advocacy for smarter energy usage, and partnership with industry experts, academia and non-governmental organizations (NGOs). Prior to Ingersoll Rand, Mr. Camuti was founder and president of Smart Grid Applications for Siemens Energy, Inc. from May 10, 2010 to July 31, 2011 and Chief Executive Officer of Siemens Corporate Research from April 1, 2005 to July 31, 2011, one of Siemens Corporate Technology innovative research centers worldwide. Additional experience includes leadership roles with Siemens Energy and Automation, where he founded the company’s Industrial Software business, as well as work with Eaton Corporation and Westinghouse Electric. Mr. Camuti serves on various boards and advisory councils, including the board of The Alliance to Save Energy and as chairman of Discovery Place, Charlotte’s Science and Technology Centers. Mr. Camuti holds a bachelor’s degree in Engineering from Lehigh University in Bethlehem, Pennsylvania, and completed the Siemens Advanced Management Program at The Fuqua School of Business at Duke University in Durham, North Carolina. We believe Mr. Camuti should serve as a member of the Board because he would bring global experience in innovation, technology and sustainability within large public companies that would enhance many of the Company’s current initiatives. | | | | | John F. Hartner | | 58 | | Mr. Hartner has served as our Chief Executive Officer since May 2019 after joining the Company in November 2018 as Chief Operating Officer. He began serving on our Board on May 13, 2020. Mr. Hartner founded Digital Industrialist LLC, a company that invests in and advises digital manufacturing businesses, in 2017 and has led the company since that time. Prior to that, Mr. Hartner served as the Chief Operating Officer of EnvisionTEC Inc., a 3D printing firm, from March 2015 to April 2017, where he was responsible for all global business operations. This role followed a nearly 15-year career leading business units of Dover Corporation across the globe from December 2000 to March 2015, where Mr. Hartner served as the President and Chief Executive Officer of the Dover Printing & Identification Segment, among other positions. Mr. Hartner represents ExOne as a founding member of the Additive Manufacturing Green Trade Association. Mr. Hartner received an M.B.A. from the University of Chicago — Graduate School of Business in 1989 and a B.S. in Mechanical Engineering from Villanova University in 1985. Mr. Hartner’s business experience in digital manufacturing and global printing provides the Board with specialized industry knowledge. As Chief Executive Officer of the Company, Mr. Hartner also contributes his unique insight into the Company’s business operations, opportunities, and challenges. |

| | | | | Name | | Age | | Experience and Qualification | | | | | John Irvin | | 6166 | | Mr. Irvin began serving on our Board on January 1, 2013, when we were formed as a Delaware corporation. Since September 2015,From October 2016 to October 2017, Mr. Irvin served as the Chief Financial Officer of Mine Vision Systems Inc., a 3D vision and mine mapping software company. Mr. Irvin has been analso served as a senior advisor to Rockwell Forest Products, Inc., a forest products company. From January 2014 through August 2015, he served incompany controlled by S. Kent Rockwell, since September 2015. He was previously employed by the role ofCompany, serving as Special Advisor to the Chairman of ExOne. FromExOne from January 2014 through August 2015 and as Chief Financial Officer from October 2012 until December 2013, Mr. Irvin served as our Chief Financial Officer.2013. From 2008 to 2012, he was President of PartnersFinancial, a national insurance brokerage company owned by National Financial Partner Corp. (“NFP”), a publicly-traded diversified financial services firm. From 1993 to 2008, he was Chairman and Chief Executive Officer of Innovative Benefits Consulting, Inc., a life insurance consulting firm and wholly-owned subsidiary of NFP. From 1983 to 1993, Mr. Irvin was a partner of Mid Atlantic Capital Group, a financial services company, which he co-founded in 1983 and where his highest position was Vice Chairman. In 1979, Mr. Irvin formed the certified public accounting firm of John Irvin and Company. From 1976 to 1979, he was an accountant for Arthur Andersen LLP. From 2000 to 2004, Mr. Irvin served on the Board of Directors of Sensytech Inc., which was engaged in the design, development, and manufacture of electronics and technology products for the defense and intelligence markets in the United States, and also served on its audit committee from 2000 to 2004 and as chairman of the audit committee from 2002 to 2004. Upon the merger of Sensytech Inc. into Argon ST, Inc., a public company engaged primarily in defense contracting, he served as director and chairman of the audit committee from 2004 to 2010. Mr. Irvin currently serves on the Boards of Directors of the S. Kent Rockwell Foundation and the PartnersFinancial Foundation.Foundation, where he is Chairman of the Board. Mr. Irvin was selected to serve as a director of ExOne because of his significant financial and accounting experience, having served in the financial services industry for a number of years and as an accountant for Arthur Andersen before forming his own certified public accounting firm.LLP. Mr. Irvin brings expertise to the Board in the areas of financial analysis and reporting, internal auditing and controls and risk management oversight. He also is able to provide both strategic and operational vision and guidance to the Board, having served in several executive-level positions before joining ExOne. | | | | Raymond J. Kilmer | | 50 | | Dr. Kilmer began serving on our Board on February 12, 2013. Dr. Kilmer has been Executive Vice President and Chief Technology Officer of Alcoa Inc., a world-wide manufacturer and supplier of aluminum products, since 2011. Prior to that, he was Vice President-Technology and Engineering of Alcoa Mill Products from 2008 to 2011, and Global Director-Automotive Flat Rolled Products for Alcoa Inc. from 2006 to 2008. We believe that Dr. Kilmer’s engineering background and extensive career managing operations at Alcoa, a large, global, high-technology company, complements ExOne’s high-technology business needs and his experience and expertise in this industry enables him to provide expert advice to ExOne on a range of technical, operational, commercial and strategic matters. |

| | | | | Name | | Age | | Experience and Qualification | | | | | Gregory F. Pashke | | 6873 | | Mr. Pashke began serving on our Board on May 18, 2016. Mr. Pashke has served as President of Pashke Consulting, a strategic, tactical and valuation consulting services company since 1997. Mr. Pashke was a founding and managing partner of Pashke Twargowski & Lee, a northwestern Pennsylvania regional CPAcertified public accountant (“CPA”) firm from 1974 to 1997. In addition to managing the firm, Mr. Pashke provided managerial and financial consulting and auditing and accounting assurance services primarily to closely held manufacturing and service enterprises. Mr. Pashke was Vice-President of Finance for Keystone Aeronautics, a multi-state air charter, aircraft sales and fuel concession enterprise from 1973 to 1974 and was a Senior Accountant with the auditing firm of Ernst & Young from 1971 until 1973. Mr. Pashke has been active in many professional organizations, having served on the National Governing Council of the American Institute of CPAs and as National Vice President of the Society for the Advancement of Management. He has served on the Board of Directors of the Institute of Management where he chaired the Long-Range Objectives and Nominations Committees.Accountants, Palm Beach Chapter, since 2011. Mr. Pashke also was a member of the Governing Council and the Executive Committee of the Pennsylvania Institute of Certified Public Accountants (“PICPA”), where he chaired the Long-Range Objectives and Nominations Committees. Mr. Pashke also served on the Ethics and Centennial Committees and as the President of the Erie Chapter of the PICPA. Mr. Pashke has obtained multiple professional designations in accounting (CPA, CMA – Certificate in— Certified Management Accounting)Accountant), finance (CFM –— Certified in Financial Management)Manager), consulting (CMC –— Certified Management Consultant) and valuation (CBA –— Certified Business Appraiser) and he holds an MBAM.B.A. from the University of Pittsburgh. Mr. Pashke has also authored over thirty articles on a variety of consulting, planning, managerial, auditing, tax and organizational topics. We believe thatHis articles have appeared in The Futurist, Strategic Finance, the Pennsylvania and New York CPA Journals, and Renaissance Executive Forum publications. Mr. Pashke should serve as a member of our Board because he will bringcontributed chapters to several Lexis/Nexis Canadian Financial Industry texts. Mr. Pashke brings significant financial accounting and reporting, financial planning, tax, internal auditing and ethics expertise to our Board, including through his robust experience in these areas with manufacturing and service enterprises. |

| | | | | Name | | Age | | Experience and Qualification | | | | | S. Kent Rockwell | | 7176 | | Mr. Rockwell began serving on our Board on January 1, 2013, and has served as our Chairman andsince that time. He served as our Chief Executive Officer sincefrom June 2018 to May 15, 2019, and previously served as our Executive Chairman from August 2016 to June 2018 and as our Chief Executive Officer from January 1, 2013, when we were formed as a Delaware corporation.corporation, until August 2016. Prior to that, date, Mr. Rockwell served as the Managing Member of The Ex One Company, LLC, our predecessor, since 2008.from 2008 until 2012. Mr. Rockwell has been the Chairman and Chief Executive Officer of Rockwell Venture Capital, Inc., a private venture capital company, since 1983 and of Appalachian Timber Services, a supplier of timber products for railroads, since 1986. Mr. Rockwell served as Vice Chairman of Argon ST, a public company engaged primarily in defense contracting, from 2004 to 2010. Mr. Rockwell served as the Chairman and Chief Executive Officer of Sensytech Inc., which was engaged in the design, development and manufacture of electronics and technology products for the defense and intelligence markets in the United States, from 1998 to 2004. He was Chairman and Chief Executive Officer of Astrotech International Corp., a public company in the oilfield supply business, from 1989 to 1997. From 1987 to 1989, he was Chairman and Chief Executive Officer of Special Metals Corp., a producer of super alloy and special alloy products. From 1978 to 1982,1980, he was Chairman and Chief Executive Officer of McEvoy Oilfield Equipment, a producer of oilfield equipment. Mr. Rockwell served on the Board of Directors of Rockwell International from 1973 until 1982 and served as President of the Energy Products Group of Rockwell International from 1977 to 1982. We believeThe Board believes that Mr. Rockwell should serve as a member of ourthe Board because he has intimate knowledge of ExOne, its business and operations and the risks, challenges and opportunities it faces. In addition, Mr. Rockwell brings to ourthe Board nearlymore than forty years of experience with strategic planning, acquisitions and integration, marketing, finance and accounting, operations and risk management, having served in numerous executive and director positions at other public and private companies before joining ExOne. |

| | | | | Name | | Age | | Experience and Qualification | Lloyd A. Semple | | 76 | | Mr. Semple began serving on our Board on February 5, 2013 and currently serves as our Lead Director. He served as a professor of law at the Detroit Mercy School of Law in Detroit, Michigan from 2004 through his retirement in 2015 (serving as its dean from 2009 to 2013). Prior to 2004, he practiced law at Dykema Gossett, a Detroit-based law firm, where he was Chairman and Chief Executive Officer from 1995 to 2002. He has served as outside counsel and director for several business enterprises. He was a director of Argon ST from 2004 to 2010. Mr. Semple brings to our Board extensive legal and corporate governance expertise and experience from his nearly forty-year career as an attorney in private practice, where he focused primarily on general corporate matters, mergers and acquisitions, and financial markets and services. His extensive service as counsel and director of several businesses has been extremely beneficial as he serves as the Lead Director of our Board. | | | | | William F. Strome | | 6166 | | Mr. Strome began serving on our Board on May 4, 2015. Since August 2015, Mr. Strome has served as an adjunct professor at the John F. Donahue Graduate School of Business, Duquesne University. Mr. Strome also currently serves as a directoron the boards of the Merle E. Gilliand & Olive Lee Gilliand Foundation a position he has held since February 2014, and sinceAspinwall Riverfront Park. From October 2014 hasto July 2017 (when the company was sold), Mr. Strome served as a director of FBR & Co. (NASDAQ:FBRC)(“FBR”), a publicly traded company providing investment banking, merger and acquisition advisory, institutional brokerage, and research services. He also served as a member of the audit committee of FBR’s board. Mr. Strome previously served as Senior Vice President, Finance & Administration of RTI International Metals, Inc. (NYSE:RTI)(“RTI”), from November 2007 until his retirement in April 2014.2014, during which time RTI was a NYSE-listed global supplier of advanced titanium products primarily to the commercial aerospace market. He led the Company’spublic company’s strategic planning activities, acquisition and divestiture initiatives, and capital procurement as well as investor relations and treasury functions. He was also responsible for RTI’s information technology and insurance functions. In 2006 and 2007, prior to joining RTI, Mr. Strome was a principal at Laurel Mountain Partners where he focused on raising acquisition financing for its principal portfolio company –— Liberty Waste Services. From 2001 to 2006, Mr. Strome was a Senior Managing Director in FBR’s Investment Banking group. From 1997 to 2001, he served as a Managing Director of the capital markets broker-dealer of PNC Financial Services Group, Inc. (NYSE: PNC), focusing on mergers and acquisitions as well as strategic advisory services, and from 1981 to 1997, he served as Deputy General Counsel and Corporate Secretary at PNC Financial Services Group, Inc. (NYSE: PNC) and from 1997 to 2001 he served as a Managing Director of PNC’s capital markets broker-dealer, focusing on mergers and acquisitions as well as strategic advisory services.PNC. Mr. Strome holds an undergraduate degree in Economics from Northwestern University and a J.D. and M.B.A. from the University of Pittsburgh. Mr. Strome brings a high level of financial, strategic and corporate governance expertise to the Board based on his experience as a senior financial executive officer of RTI, andincluding leading its treasury functions, his experience as a Senior Managing Director in FBR’s Investment Banking group, and as Deputy General Counsel and Corporate Secretary of PNC. In addition, Mr. Strome also has prior experience serving on a public company’s board and audit committee. The Board has determined that Mr. Strome’s experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an “audit committee financial expert” for purposes of membership on our Audit Committee. |

| | | | | Name | | Age | | Experience and Qualification | | | | | Roger W. Thiltgen | | 70 | | Mr. Thiltgen began serving on our Board on August 8, 2018. Since 1992, he has been majority owner and President of Tanglewood Resort Properties Inc., which operates a Resort Hotel, Conference Center and Real Estate Development in North Texas. Mr. Thiltgen also currently serves as President of Champion Resources Inc., a privately held investment company dealing primarily with oil and gas and real estate investments, a position he has held since 1986. From 2014 to 2017, Mr. Thiltgen served as the managing member of Puris LLC, a firm primarily engaged in the manufacture of titanium powder, and to a lesser extent in printing titanium powder utilizing binder jetting 3D printers provided by ExOne. Additionally, Mr. Thiltgen previously served as a board member and Manager of Corporate Development for Astrotech International Corporation, formerly listed on the American Stock Exchange, a company that manufactured, repaired, and serviced above ground storage tanks for the oil and gas industry (1989-1996). He was also Co-Founder and President of HMT Inc., an engineering and consulting company that was acquired by Astrotech (1978-1989). At HMT, he received three U.S. patents for emission control devices manufactured and sold by HMT. Mr. Thiltgen holds a B.S. in Civil Engineering from The University of Wisconsin-Platteville. The Board has determined that Mr. Thiltgen’s technical knowledge, experience with the Company’s machines, and background in emerging technology businesses will assist the Board as it makes decisions to further advance binder jetting technology for industrial applications. | | | | | Bonnie K. Wachtel | | 6065 | | Ms. Wachtel began serving on our Board on February 12, 2013. She ishas been a principal and director of Wachtel & Co., Inc., an investment firm in Washington, D.C. involved with the development of growing companies. Since joining Wachtel & Co., Inc. in 1984,companies, since 1984. Ms. Wachtel has been a director of more than a dozen public and private corporations. She has been a director of VSE Corporation (Nasdaq: VSEC), a provider of engineering services principally to the federal government, since 1991 and of Information Analysis Inc., a provider of ITinformation technology technical services, since 1992. She was a director of Integral Systems Inc. (NASDAQ:ISYS), a provider of satellite related software and services, from 2010 to 2011. Ms. Wachtel servesHer industry experience includes service on the Advisory Committee for the National Market System Consolidated Audit Trail, LLC, an entity created by order of the SEC (2018-2020), and the Hearings Panel for Nasdaq Listing Qualifications Panel for NASDAQ.(2006 to 2016). She practiced law at Weil, Gotshal & Manges in New York from 1980 to 1984. Ms. Wachtel brings substantial corporate governance and regulatory compliance expertise to our Board, having served as a director for more than a dozen public and private corporations and on the Listing QualificationsHearings Panel for NASDAQ.Nasdaq Listing Qualifications. She also worked for years as an attorney in private practice, during which time she focused primarily on business law, corporate finance and securities law. In addition, Ms. Wachtel alsoholds an M.B.A. in Finance from the University of Chicago and is a certified financial analyst, and asChartered Financial Analyst. As such, she brings significant expertise to ourthe Board (and our Audit Committee, on which she serves) in the areas of financial analysis and reporting, internal auditing and controls and risk management oversight. |

EXECUTIVE OFFICERS OF EXONE The following table and the discussion below provide information about our executive officers as of March 29, 2016, each of whom is15, 2021. Each elected annually.officer holds office until his or her successor has been duly elected or until his or her earlier death, resignation or removal. | | | | | | | Name | | Age | | | Positions and Offices Held with ExOne | S. Kent RockwellJohn F. Hartner

| | | 7158 | | | Chairman of the Board and Chief Executive Officer | JoEllen Lyons Dillon

| | | 52 | | | Executive Vice President, Chief Legal Officer and Corporate Secretary | Rainer HoechsmannLoretta L. Benec

| | | 50 | | | Chief Development OfficerVice President, General Counsel and General Manager of ExOne GmbHCorporate Secretary | Rick Lucas | | | 5055 | | | Chief Technology Officer and Vice President of New Markets | Hans J. SackDouglas D. Zemba

| | | 62 | | | President | Brian W. Smith

| | | 5841 | | | Chief Financial Officer and Treasurer |

S. Kent RockwellJohn F. Hartner — Mr. Rockwell’sHartner’s biography is set forth under “Proposal No. 1 – — Election of Directors” above.

JoEllen Lyons DillonLoretta L. Benec — Ms. DillonBenec has served as our Executive Vice President Chief Legal Officersince April 2020 in addition to her roles as our General Counsel and Corporate Secretary, which she has held since December 2014, and she previously served as our Chief Legal Officer and Corporate Secretary beginning in March 2013. From May 2012 through February 2013, she was a legal consultant on our initial public offering. She previously was a partner at two national law firms, Reed Smith LLP from 2002 until 2011 and Buchanan Ingersoll & Rooney PC from 1988 until 2002, where she became a partner after starting as an associate with the firm.October 2017. Ms. Dillon has served on the Board of Directors of Mylan N.V., a global pharmaceutical company, since May 2014. She also serves on the Mylan Board’s Compliance Committee. Ms. Dillon was the former Chair,Benec co-founded and currently serves as the Audit Committee Chair,Co-Ambassador of the Allegheny District chapterWomen in 3D Printing – Pittsburgh Chapter. From November 2016 to June 2020, Ms. Benec provided occasional corporate and commercial legal services as General Counsel to Cumberland Highstreet Partners, Inc., a manufacturing consulting business. Previously, Ms. Benec was Assistant General Counsel for RTI International Metals, Inc. (now Howmet Aerospace Inc.), a NYSE-listed global supplier of the National Multiple Sclerosis Society. She also is a Vice President of the Wine & Spirits Advisory Counciladvanced titanium products primarily to the Pennsylvania Liquor Control Board.

Rainer Hoechsmann — Mr. Hoechsmann hascommercial aerospace market, from July 2010 to August 2015, and also served as Chief Development Officer since January 2014,its Secretary from April 2013 to August 2015 and also has served as General Managerits Director of ExOne GmbH,Corporate Governance from July 2010 to April 2013. Prior to RTI, Ms. Benec enjoyed a subsidiarymore than twelve-year career in the law department of ExOne, since 2003. He is responsible for our operations in Europe.Mr. Hoechsmann is the inventor and co-inventor of certain AM technology covered byH. J. Heinz Company (now The Kraft Heinz Company), a number of our patents. In 2003, he co-founded Prometal RCT GmbH in Augsburg, Germany, which is the predecessor to ExOne GmbH. In 1999, he co-founded Generis GmbH, one of the first companies implementing 3D printing applications. Mr. Hoechsmann hasNYSE-listed global packaged food company. Ms. Benec received a number of industry awards, includingB.A. in History with High Honors, cum laude, from Dartmouth College in 1992 and a J.D., cum laude, from the OCE Printing Award from OCE Printers AG, the Technical University of Munich Award for 3D Printing and the McKinsey & Company Start-Up Award. He is a memberPittsburgh School of the Association of German Engineers.Law in 1995.

Rick D. Lucas — Mr. Lucas has served as our Chief Technology Officer since June 2012. He served in2012 and as our Vice President of New Markets since January 2019. Prior to joining ExOne, he held various positions from October 2001 to June 2012 at Touchstone Research Laboratory, a broad-based product development research facility that focuses on the development of next-generation materials and products, where he directed operations and research activities and served as Director of Operations from March 2010 to June 2012. From November 1989 to October 2001, Mr. Lucas managed product development for Lake Shore Cryotronics, a privately held developer of cryogenic temperature sensors and other instrumentation. He currently is serving on the Governance Board for the National Additive Manufacturing Innovation Institute (NAMII), an additive manufacturing center. Hans J. Sack— Mr. Sack has served as our President since March 2015. Prior to becoming the President of the Company, he served on our Board of Directors (and chaired the Strategic Oversight Committee) from December 2014 to March 2015. Mr. Sack was a Managing Director of Headwaters | SC, a private consulting firm, from 2013 to March 2015. In that position, Mr. Sack worked on client engagements on matters relating to business growth strategy development and implementation, operational improvement initiatives, and acquisition and consolidation strategies and related due diligence. Prior to joining Headwaters, from 2010 to 2012, Mr. Sack served as President

and CEO of Berg Steel Pipe Corp., the U.S. subsidiary of Europipe GmbH, a global leader in large diameter pipe for oil and gas pipelines. Mr. Sack served as President and CEO of Latrobe Specialty Steel Company, a producer of aerospace metals and tool steels owned by private equity firms, from 2006 to 2009. From 1990 to 2006, Mr. Sack worked for The Timken Company’s (NYSE: TKR) steel business, which is now known as TimkenSteel Corporation (NYSE: TMST), beginning in 1990 as a senior steel business specialist, serving in subsequent positions in the Steel Group as manager–small bar mill, project manager–parts strategy, general manager–precision steel components, and vice president–manufacturing–steel, becoming President & CEO of Timken Latrobe Steel in 1996 and becoming an officer of The Timken Company in 1998. Mr. Sack received a master’s degree in mechanical engineering from RWTH Aachen, Germany, and a master’s degree in business administration from the Harvard University Graduate School of Business Administration. Mr. Sack is a member of the Board of Directors of Saint Vincent College and its McKenna School of Business, Economics and Government.

Brian W. SmithDouglas D. Zemba — Mr. SmithZemba has served as our Chief Financial Officer and Treasurer since July 2018, and he previously served as our Chief Accounting Officer from March 2013 to July 2018. Mr. Zemba joined the Company in January 2014.2013 as Director of Finance shortly before the Company’s initial public offering in February 2013. Prior to joining the Company, Mr. Smith previouslyZemba was an Assurance Client Service Partnera Senior Manager in the Assurance practice of the Pittsburgh, Pennsylvania office of PricewaterhouseCoopers LLP (“PwC”). Mr. SmithZemba joined PwC in 1984, was admitted as a Partner2003 holding various positions within the Assurance practice servicing both public and private clients in 1995, and spent several years working in a PwC advisory business assistingthe manufacturing, industrial products, healthcare and energy companies with internal control reviews, system implementations, process transformation and change management.metals industries. Mr. Smith held various leadership roles within PwC, including leading initiatives in specific consumer and industrial product sectors. Mr. Smith is a Certified Public Accountant andZemba received a B.A. with a concentrationB.S. in accounting and minorAccounting from the Pennsylvania State University in economics from Westminster College in 1980.2002.

CORPORATE GOVERNANCE Highlights of Our Corporate Governance Practices Our Board is committed to establishing and maintaining corporate governance policies and practices that are appropriate for a company like ExOne. Highlights of our implemented measures include: Strong independentIndependent Lead Director and enhanced use of independent committees to ensure a balanced process;

Annual election of directors; Majority voting standard for non-contested election of directors; Supermajority of independent directors on the Board (5 out of 78 independent directors upon election at 20162021 Annual Meeting); 100% independent members on Audit, Compensation and Nominating and Governance Committees; Stock ownership and retention policy for directors and executive officers; Anti-hedging and anti-pledging policies for directors, officers and executive officers;employees; Clawback policy for restatement of financial statements; Succession and executive talent planning at the Board level; Strong ethicsEthics policy, whistleblower policy and international policies on import and export matters;

Process for review and approval of related person transactions; Establishment of a committee of senior executives to oversee the Company’s environmental, social and governance initiatives and disclosures; Board compensation in form and amount appropriate for our size and state of development; and Annual Board self-evaluation process. Structure and Size of the Board Our Board may establish the authorized number of directors from time to timetime-to-time by resolution, as permitted under our Bylaws. Currently, the Board has established that the Board will have seveneight (8) members. OurEach of our current directors (if(other than Mr. Semple, who is retiring as of the Annual Meeting) and Mr. Camuti, our new director nominee, if elected at the Annual Meeting)Meeting, will continue to serve until the 20172022 Annual Meeting of Stockholders, until his or her successor has been elected or qualified, or until his or her earlier death, resignation or removal. Independence of the Board and Committees A majority of our directors are independent under the applicable rules of NASDAQ.Nasdaq. The Board determined in February 20162021 that Messrs. Kilmer, Sellier,Pashke, Semple, Strome and StromeThiltgen, and Ms. Wachtel, each qualify as an independent directorsdirector in accordance with the published listing requirements of NASDAQ.Nasdaq. The Board also determined that Gregory F. Pashke,Mr. Camuti, a nominee for election to the Board, will also qualify as an independent director in accordance with the NASDAQpublished listing requirements of Nasdaq if he is elected to the Board at the 20162021 Annual Meeting. Finally, the Board determined that Mr. Sack was independent during his tenure on the Board from December 2014 to March 2015. As required by the NASDAQNasdaq rules, the Board has made a subjective determination as to each independent director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and ExOne with regard to each director’s business and personal activities as they may relate to us and our management. Upon the election of the directors at the 20162021 Annual Meeting, we will have five (5) out of seveneight (8) independent directors on the Board, and each committeethe Audit, Compensation and Nominating and Governance Committees will have only independent members. Board Leadership Structure and Ourour Independent Lead Director Our Bylaws give the Board the flexibility to determine whether the roles of Chief Executive Officer and Board Chairman should be held by the same person or by two separate individuals. Currently, S. Kent Rockwell serves as both our Chairman and Chief Executive Officer. As the founder of the Company Mr. Rockwell has been managing ExOne (or its predecessors) since 2008.

At this time, the Board has determined that having Mr. Rockwell serve as both theand former Chief Executive Officer and Executive Chairman of the Company, the Board believes that Mr. Rockwell is uniquely positioned to serve as Chairman is inand continue to take the best interest of our stockholders. We believe this structure makeslead on strategic planning for the best use of Mr. Rockwell’s extensive knowledge of ExOne, our strategic initiativesCompany and our industryleading the Board by setting Board agendas and presiding at Board meetings. The Company’s Chief Executive Officer, John F. Hartner, also fosters real-time communication between management andserves as a director on the Board.

The Board also has always elected Mr. Semple to serve as thea Lead Director from one of our independent directors. Asdirectors, which is an important role for our Company to provide leadership to the Board if circumstances arise in which Mr. Rockwell (who is also a significant stockholder) may be, or may be perceived to be, in conflict with the Company. Since 2013, Lloyd A. Semple has served as our Lead Director. On February 2, 2021, Mr. Semple notified the Board of his decision to retire at the end of his current director term on May 12, 2021 and not stand for reelection at the Annual Meeting. Following the election of directors at the Annual Meeting, the Board intends to elect an independent director as its new Lead Director. The Lead Director, Mr. Semple:among other things: Regularly meets with and assists the Chairman and Chief Executive Officer in preparing for meetings of the Board;

Presides at executive sessions of the independent directors; Provides leadership to the Board if circumstances ariseRegularly meets with and assists Mr. Rockwell in which the rolepreparing for meetings of the Chairman and Chief Executive Officer may be, or may be perceived to be, in conflict and also chairs theBoard;